Oregon Vehicle Privilege Tax Calculator . vehicle privilege tax—what is it? the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. Have 7,500 or fewer miles. Go to www.oregon.gov/dor, click on revenue online. Under “register” click on “vehicle and. a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. Fast, easy, & secure24/7 assistance The vehicle use tax applies to vehicles. Fast, easy, & secure24/7 assistance the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. The vehicle privilege tax applies to vehicles that: under quick links, click on file a return. In the top menu bar. tax on new vehicle sales.

from www.templateroller.com

a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. Have 7,500 or fewer miles. under quick links, click on file a return. Go to www.oregon.gov/dor, click on revenue online. vehicle privilege tax—what is it? Fast, easy, & secure24/7 assistance Under “register” click on “vehicle and. Fast, easy, & secure24/7 assistance tax on new vehicle sales.

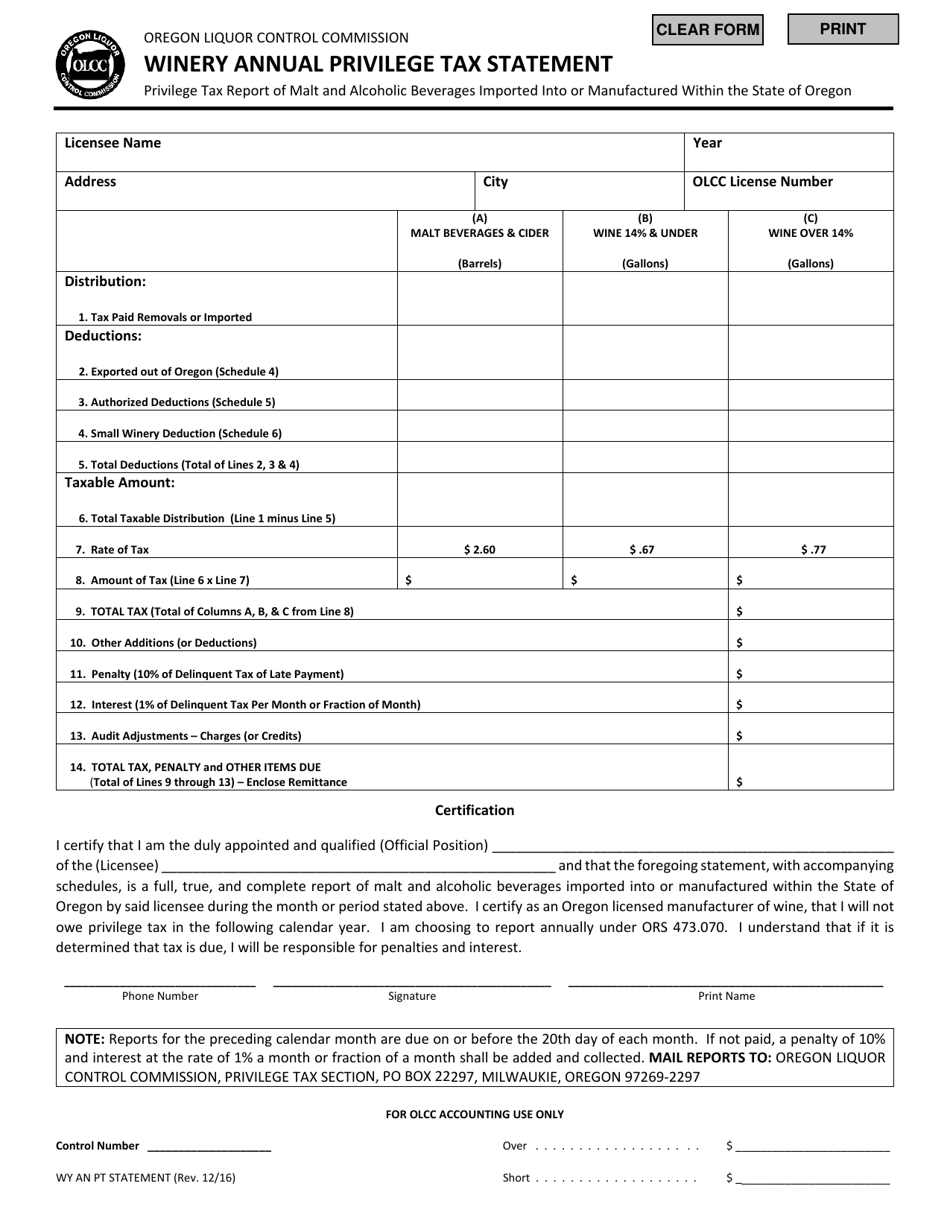

Oregon Winery Annual Privilege Tax Statement Fill Out, Sign Online

Oregon Vehicle Privilege Tax Calculator vehicle privilege tax—what is it? under quick links, click on file a return. Go to www.oregon.gov/dor, click on revenue online. Have 7,500 or fewer miles. The vehicle privilege tax applies to vehicles that: Under “register” click on “vehicle and. a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. Fast, easy, & secure24/7 assistance vehicle privilege tax—what is it? tax on new vehicle sales. Fast, easy, & secure24/7 assistance In the top menu bar. the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. The vehicle use tax applies to vehicles. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon.

From legaltemplates.net

Free Oregon Motor Vehicle Bill of Sale Form Legal Templates Oregon Vehicle Privilege Tax Calculator tax on new vehicle sales. the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. Go to www.oregon.gov/dor, click on revenue online. vehicle privilege tax—what is it? The vehicle privilege tax applies to vehicles that: The vehicle use tax applies to vehicles. Fast,. Oregon Vehicle Privilege Tax Calculator.

From taxwithholdingestimator.com

Oregon W4 Calculator 2021 Tax Withholding Estimator 2021 Oregon Vehicle Privilege Tax Calculator In the top menu bar. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. Go to www.oregon.gov/dor, click on revenue online. tax on new vehicle sales. The vehicle use tax applies to vehicles. under quick links, click on file a return. Fast, easy, & secure24/7 assistance vehicle privilege tax—what is. Oregon Vehicle Privilege Tax Calculator.

From eforms.com

Free Oregon Motor Vehicle Bill of Sale Form 735501 PDF eForms Oregon Vehicle Privilege Tax Calculator tax on new vehicle sales. The vehicle privilege tax applies to vehicles that: Fast, easy, & secure24/7 assistance In the top menu bar. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. under quick links, click on file a return. The vehicle use tax applies to vehicles. vehicle privilege tax—what. Oregon Vehicle Privilege Tax Calculator.

From www.templateroller.com

Form 735501 Download Fillable PDF or Fill Online Vehicle Bill of Sale Oregon Vehicle Privilege Tax Calculator The vehicle privilege tax applies to vehicles that: the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. Fast, easy, & secure24/7 assistance Have 7,500 or fewer miles. In the top menu bar. tax on new vehicle sales. the use tax shall be reduced, but not below zero, by the amount of. Oregon Vehicle Privilege Tax Calculator.

From legaltemplates.net

Free Oregon Motor Vehicle Bill of Sale Form Legal Templates Oregon Vehicle Privilege Tax Calculator a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. Have 7,500 or fewer miles. Go to www.oregon.gov/dor,. Oregon Vehicle Privilege Tax Calculator.

From www.taxuni.com

Oregon Sales Tax 2023 2024 Oregon Vehicle Privilege Tax Calculator a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. tax on new vehicle sales. Have 7,500 or fewer miles. The vehicle use tax applies to vehicles. Go to www.oregon.gov/dor, click on revenue online. the vehicle privilege tax is a tax. Oregon Vehicle Privilege Tax Calculator.

From formspal.com

Free Oregon Bill of Sale Forms (PDF) FormsPal Oregon Vehicle Privilege Tax Calculator the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. under quick links, click on file a return. vehicle privilege tax—what is it? Under “register” click on “vehicle and. tax on new vehicle sales. Fast, easy, & secure24/7 assistance Go to www.oregon.gov/dor, click on revenue online. The vehicle use tax applies. Oregon Vehicle Privilege Tax Calculator.

From hardimancerezas.blogspot.com

Oregon Salary Paycheck Calculator Oregon Vehicle Privilege Tax Calculator tax on new vehicle sales. a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. The vehicle privilege tax applies to vehicles that: Fast, easy, & secure24/7 assistance under quick links, click on file a return. The vehicle use tax applies. Oregon Vehicle Privilege Tax Calculator.

From www.signnow.com

Oregon Privilege Tax Online 20162024 Form Fill Out and Sign Oregon Vehicle Privilege Tax Calculator The vehicle use tax applies to vehicles. vehicle privilege tax—what is it? Fast, easy, & secure24/7 assistance the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. In. Oregon Vehicle Privilege Tax Calculator.

From or-us.icalculator.com

2023 Oregon State Tax Calculator for 2024 tax return Oregon Vehicle Privilege Tax Calculator Go to www.oregon.gov/dor, click on revenue online. Under “register” click on “vehicle and. under quick links, click on file a return. vehicle privilege tax—what is it? the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. tax on new vehicle sales. a car payment with oregon tax, title, and license. Oregon Vehicle Privilege Tax Calculator.

From oysterlink.com

Oregon Paycheck Calculator Calculate Your Net Pay Oregon Vehicle Privilege Tax Calculator Fast, easy, & secure24/7 assistance The vehicle use tax applies to vehicles. Fast, easy, & secure24/7 assistance Go to www.oregon.gov/dor, click on revenue online. tax on new vehicle sales. under quick links, click on file a return. Have 7,500 or fewer miles. vehicle privilege tax—what is it? In the top menu bar. Oregon Vehicle Privilege Tax Calculator.

From www.oregonlive.com

A brief history of Oregon vehicle fees and fuel taxes Oregon Vehicle Privilege Tax Calculator Go to www.oregon.gov/dor, click on revenue online. In the top menu bar. Have 7,500 or fewer miles. under quick links, click on file a return. vehicle privilege tax—what is it? the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. a car payment with oregon tax, title, and license included is. Oregon Vehicle Privilege Tax Calculator.

From federal-withholding-tables.net

oregon tax withholding calculator 2021 Federal Withholding Tables 2021 Oregon Vehicle Privilege Tax Calculator the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. The vehicle use tax applies to vehicles. Under “register” click on “vehicle and. vehicle privilege tax—what is it? tax on new vehicle sales. Fast, easy, & secure24/7 assistance Have 7,500 or fewer miles. Fast, easy, & secure24/7 assistance a car payment. Oregon Vehicle Privilege Tax Calculator.

From us.icalculator.com

Oregon Salary After Tax Calculator 2024 iCalculator™ Oregon Vehicle Privilege Tax Calculator Under “register” click on “vehicle and. under quick links, click on file a return. Go to www.oregon.gov/dor, click on revenue online. vehicle privilege tax—what is it? In the top menu bar. The vehicle use tax applies to vehicles. a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72. Oregon Vehicle Privilege Tax Calculator.

From www.templateroller.com

Oregon Lesser Privilege Statement Fill Out, Sign Online and Download Oregon Vehicle Privilege Tax Calculator tax on new vehicle sales. the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. Under “register” click on “vehicle and. under quick links, click on file a return. vehicle privilege tax—what is it? Fast, easy, & secure24/7 assistance a car. Oregon Vehicle Privilege Tax Calculator.

From www.veche.info

Oregon Tax Calculator 2020 » Veche.info 16 Oregon Vehicle Privilege Tax Calculator The vehicle privilege tax applies to vehicles that: Under “register” click on “vehicle and. Have 7,500 or fewer miles. under quick links, click on file a return. vehicle privilege tax—what is it? In the top menu bar. the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use. Oregon Vehicle Privilege Tax Calculator.

From powerefficiency.com

Oregon Electric Vehicle Tax Credit Turbocharge Your Savings for Oregon Vehicle Privilege Tax Calculator the vehicle privilege tax is a tax for the privilege of selling vehicles in oregon. vehicle privilege tax—what is it? the use tax shall be reduced, but not below zero, by the amount of any privilege, excise, sales or use tax imposed by any. The vehicle privilege tax applies to vehicles that: Have 7,500 or fewer miles.. Oregon Vehicle Privilege Tax Calculator.

From or-us.icalculator.com

2015 Oregon State Tax Calculator for 2016 tax return Oregon Vehicle Privilege Tax Calculator The vehicle privilege tax applies to vehicles that: Go to www.oregon.gov/dor, click on revenue online. tax on new vehicle sales. In the top menu bar. a car payment with oregon tax, title, and license included is $ 690.56 at 6.99 % apr for 72 months on a loan amount of $. the vehicle privilege tax is a. Oregon Vehicle Privilege Tax Calculator.